Direct debit and Card payments alike are very similar and because of this similarity there can be confusion so let’s look at the differences and compare them. Simply COLLECT does provide access to both payment types.

Direct Debit

This is a direct instruction of authority from your customer to their bankers to collect money from the end customer’s bank account on an agreed date and amount. The dates and values can vary when the correct notice is provided.

Card Payment

In a similar fashion, the customer has given details to allow a payment to be taken however it differs in that the payment is taken using a card that is connected to a bank account. This means if the card details change or it expires or cancels the authority has ended which can result in more administration. This is the common reason for a higher failure rate.

What should I use?

Both Direct Debit and Card Payments are used for the processing of recurring payments. The failure rate is higher for card payments due to the card being linked to a bank account and changes can occur to that card. For one-off purchases, many of our customers use our Card payment facility or hold a merchant account separately. Direct Debit is the UK’s most common payment type which is why it is used for most utility bills.

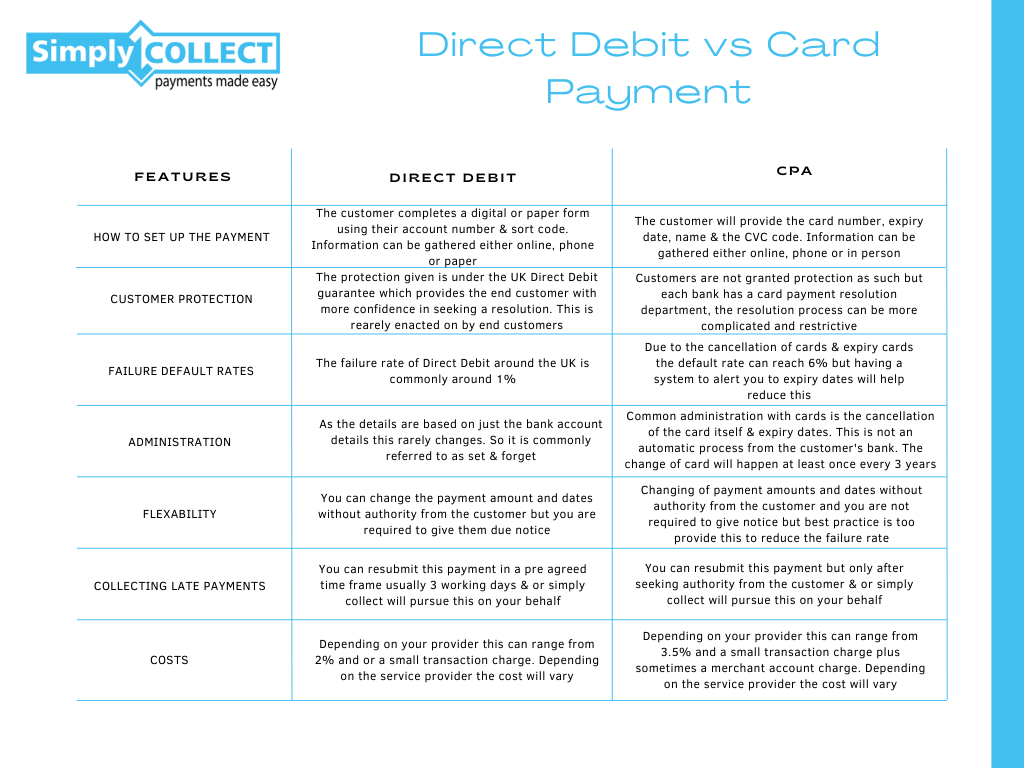

However, the choice of using either or both methods with Simply COLLECT is possible for our clients. Below we have outlined a comparison of both methods.

Simply COLLECT is a leading provider of Direct Debit and payment facilities in the UK our clients also benefit from our subscription management which enables our clients to reduce administration costs and get back to what they love! To find out more please click here or alternatively contact our team on 0330 223 3152.